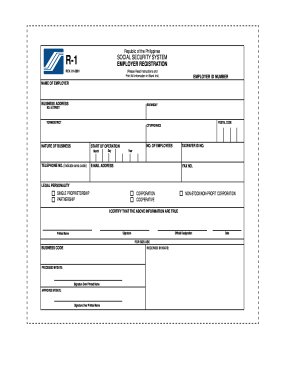

Sss Form R-1

There are so many types of for your membership account in the Philippines as well as for branches abroad thru the different Philippine Consulate offices of the DFA. SSS Contribution Payment Procedures and How To Pay InstructionsIf you are looking for information on how to pay for your monthly remittance or monthly contribution, please read below.1. Fill out this form in three (3) copies and accomplish appropriate boxes as follows:a. For business employer - employer number, business name, business address and business TIN as registered with the SSS in 'Employer Registration' (Form R-1) b. For household employer - employer number, household employer name, home address and personal TIN as registered with the SSS in 'Employer Registration' (Form R-1)2. Place a checkmark on the applicable box.

Always indicate 'N/A' or 'Not Applicable', if the required data is not applicable. Remit your contributions following the payment deadlines below for both the business employer and household'In case the payment deadline falls on a Saturday, Sunday or holiday, payment may be made on the next working day'If the 10th digit of the 13-digit Employer (ER) number ends in: / Payment deadline following the applicable month. 1 or 2 - 10th day of the month. 3 or 4 - 15th day of the month. 5 or 6 - 20th day of the month.

7 or 8 - 25th day of the month. 9 or 0 - Last day of the month5. Remit the monthly contributions of your employees/household employees through any of the following: a. SSS branch office with tellering facility b. Accredited banks c. Authorized payment centers 6.

Make all checks and postal money orders payable to SSS. Fill out properly the check details in the 'Form of Payment' portion. Submit a copy of validated 'Employer Contributions Payment Return' (Form R-5) or 'Employer Contributions Payment Return' (Form R-5) with Special Bank Receipt (SBR) together with the corresponding 'Contribution Collection List' (Form R-3) within ten (10) days after the applicable quarter or 'Contribution Collection List' (Form R-3) in electronic media device within ten (10) days after the applicable month to the nearest.For voluntary payments, please use and download the RS-5 form. SSS Branches Where You Can Pay Monthly Contribution AmortizationBelow is the list of the different offices in the Philippines as well as abroad where you can pay and make an inquiry regarding your SSS contribution as well as loan payment and repayments.

As an employer, you’re expected to comply with laws that protect the rights of employees against unfair labor practices. Regardless of the nature of your business and the number of people you hire, you have a legal and moral responsibility to provide your workers with government-mandated employee benefits under the Labor Code of the Philippines.Whether you’re a business employer, a household employer, or an HR practitioner, here are the critical things you need to know about mandatory employee benefits in the Philippines.

Pag-IBIG, PhilHealth, and SSS Employee Benefits. Instagram photo by @jojopensicaUnder the, employees are entitled to monetary benefits such as the minimum wage, and overtime pay, among many others.In addition, the Labor Code also requires employers to become members of the Pag-IBIG Fund, PhilHealth, and SSS, as well as remit monthly contributions on behalf of their employees to these government offices. This ensures that employees have access to affordable house financing, health insurance, and, as mandated by the law. Photo by Judgefloro via Wikimedia CommonsVisit the Pag-IBIG branch that maintains your records and then submit the following requirements:. SSS Certification (if you’re registered with SSS already). Proof of business existenceHow to Register as a Business Employer with PhilHealthFill out and submit these documents to any PhilHealth office:. Proof of business existence.

Sss Form R-1a Requirements

Two copies of. Two copies of for each employeeHow to Register as a Business Employer with SSSFill out and submit the and plus a photocopy of your proof of business existence to the nearest SSS office. How to Register as a Household EmployerPag-IBIG, PhilHealth, and SSS have a unified registration process for household employers. If you hired a kasambahay, fill out and submit these documents to any branch of the three government offices:.

(three copies).New Employee Registration with Pag-IBIG, PhilHealth, and SSSEach time you hire an employee or household worker, you’re responsible for updating Pag-IBIG, PhilHealth, and SSS about the new employment. This will ensure the accuracy of the employee’s records, especially their contributions, with these government agencies. How to Register New Employees with Pag-IBIGAsk your new employees to submit their Pag-IBIG Membership ID (MID) Number to you.

Those without an MID number can.To report your new employees, simply add them to the when remitting your company’s monthly Pag-IBIG contribution. Under the last column (“REMARKS”), indicate “N” (new hire) and the hiring date in MM/DD/YY format. How to Register New Employees with PhilHealthSubmit these documents to the PhilHealth office where your business is registered:. Accomplished PMRFs of new hires (whether they’re PhilHealth members or not). Two copies ofHow to Register New Employees with SSSAsk your new employees to submit their SSS number to you. Require the non-SSS members to register at the SSS branch where your company is registered.When you have the SSS numbers of all your new hires, fill out and submit an SSS Form R1-A to the branch where your company is registered. Alternatively, you can submit the form online via the My.SSS online facility.

Before you can do that, you need to. How to Register Newly Hired KasambahaysYou can register your new kasambahay with Pag-IBIG, PhilHealth, and SSS through the, a one-stop shop online registration facility. Remitting Your Employees’ Government ContributionsPhilippine labor laws require employers to deduct the monthly government contributions from their employees’ salaries and pay both the employee and employer share of contributions to Pag-IBIG, PhilHealth, and SSS. How Much Should Employers Contribute?

Pag-IBIG Contribution Rates Monthly Basic SalaryEmployer ShareEmployee SharePHP 1,500 and below2%1%Over PHP 1,5002%2%The maximum monthly compensation used to compute an employee’s Pag-IBIG contribution is PHP 5,000. For employees earning higher than PHP 5,000, the total contribution is PHP 200—you’ll have to deduct PHP 100 from their salary and subsidize the other PHP 100. PhilHealth Contribution Rates Monthly Basic SalaryEmployer ShareEmployee ShareTotal PremiumPHP 10,000 and belowPHP 137.50PHP 137.50PHP 275.00PHP 10,000.01 to PHP 39,999.99PHP 137.51 to PHP 549.99PHP 137.51 to PHP 549.99PHP 275.02 to PHP 1,099.99PHP 40,000.00 and abovePHP 550.00PHP 550.00PHP 1,100.00Employers and employees equally share the monthly contributions to PhilHealth.

Sss R3

SSS Contribution Rates. Photo from theCurrently, the SSS contribution rate is 11% of an employee’s monthly salary credit, 7.37% of which is shouldered by the employer and 3.63% is deducted from the salary. In addition to the employer share, you’ll also have to pay for your monthly contribution to the Employees’ Compensation program that costs PHP 10 (for workers earning below PHP 14,750) or PHP 30 (for those earning over PHP 14,750). Payment Due Dates to RememberTo avoid penalties for late remittances, it’s important to take note of the contribution payment due dates of each government agency. Instagram photo by @devineneneAfter deducting the monthly government contributions from your employees’ salaries, remit them along with your employer share to Pag-IBIG, PhilHealth, and SSS branches or their authorized collecting partners such as banks,.The easiest way is to use, the centralized online facility for Pag-IBIG, PhilHealth, and SSS contribution filing and payments. It’s also convenient because you can access its 24/7 service anytime.